Having to make changes to employees’ payslips from month to month isn’t unusual in business today. Salary increases and sick leave are just some of the possible reasons. It’s the HR department’s job to compile this information and ensure it gets to the person responsible for payroll. Some people do this with post-it notes, others with Excel, and problems and mistakes often arise because the information wasn’t correct.

So, what’s the solution? The key to this is understanding what a payroll adjustment is, and using specific software to automate the task. There's no doubt that a customised and digitalised system can save your HR department tons of time, as well as keeping mistakes to a minimum.

We look into the most common payroll adjustments and how a customised HR software can make your life easier.

What do we mean when we talk about payment adjustments?

When we talk about payment adjustments, we're referring to any exceptional factors that can cause changes to an employee's payslip. Sick leave, a salary increase or extra payment are just some examples.

The HR department usually compiles this information and sends it to the team member or agency that looks after payroll so they can make the necessary changes.

And it’s vital to ensure that this process runs smoothly. Incorrect adjustments can lead to an infringement of employment law, as well as creating more work afterwards to put things right.

Human error is commonplace, especially when entering data and numbers manually. So, for this reason, it’s essential to have the right tools at hand for managing payroll adjustments.

In some HR departments, this is still done with hand-written notes, private digital files or even, by memory.

The most common payroll adjustments

As we’ve already mentioned, an adjustment doesn’t have to be a problem. The term simply refers to a one-off or permanent change.

Some adjustments that recur every month can include:

New employee contract

When someone joins the company, we need to register them and prepare a contract. This adjustment can be resolved (almost) automatically so that the new joiner can sign on their first day.

Sick leave

When an employee is sick, their contract needs an adjustment because part of their salary will be paid by Social Security. Recording the start and end date of their sick leave is vital to ensure that all the information correctly balances.

Updates to employee contracts

Any updates to employee contracts, such as a salary increase, must also be reflected in their payslip. The HR team needs to monitor who’ll receive the increase applies and ensure the new salary appears in their payslip.

Extra payments

Extra payments must also be shown on the employee's payslip to reflect that the company is paying them more money that month. If the extra payment applies to everyone in the company, then it's a more straightforward process. On the other hand, results-based payments require more precise control to make sure the right amount of money reaches the right people.

Variable compensation

In some companies, it’s not unusual that part of the employees’ salary is variable, or in other words, based on achieving targets such as sales. This is particularly common in commercial roles. A payroll adjustment software enables you to assign variables for a certain period of time, both on an individual basis and for each department.

Termination of contract

Monitoring leavers is also important as you may need to calculate any end of contract adjustments such as unused annual leave and other outstanding payments. It’s vital to record the exact date the contract terminates to adjust the final payslip.

Kenjo Interface

Kenjo Interface

How to manage payroll adjustments?

As we mentioned earlier, manually adjusting payroll is never effective. Making hand-written notes or using a document on an individual computer is risky. They can easily get lost. We may often make mistakes when writing down a number, or we may even forget to make adjustments in time for the employee to receive them. Doing things manually often leads to bigger problems. It creates extra work for us by having to go back and correct payslips.

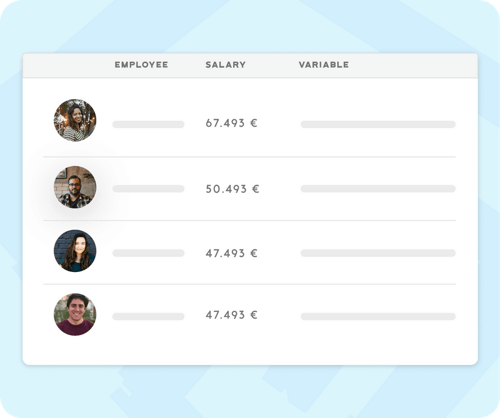

Payroll adjustment software is by far the best way to manage these tasks. These systems enable you to record and store all information automatically, which helps the HR team closely monitor processes and with greater accuracy. You can also visualise all of the changes in one single view, as well as attach medical certificates to the corresponding payslip, for example. This type of software is totally different from payroll software, since the latter focuses more on the calculation of deductions, taxes, etc.

And if you prefer, you can even give you payroll agency access to the system so that they can download the information themselves. This saves HR managers a great deal of time.

Benefits of automating payroll adjustments

- Greater control: storing all the adjustments in the same platform and sharing it with the HR team makes keeping track of the changes so much easier.

- Fewer mistakes: compiling the data and transferring to others through digital channels helps minimise the risk of error due to manual typing, distractions or forgetfulness. Payslips are a delicate subject so they must be handled as carefully as possible.

- Save time: the HR team saves time by using payroll adjustment software. It gathers all the information in one place and can quickly transfer the data to payroll specialists. And if you wish, you can even give them access to the software so they can retrieve the information themselves.

- Employee satisfaction: employees will be happier and more motivated if pay-related matters run smoothly. No-one likes unpleasant surprises in their payslip or having to complain and wait for the mistake to be corrected. Using technology makes everyone's lives easier, so it's a win-win for the entire team.

Specialist technology is hands down, the best solution for effectively managing payroll adjustments. And it saves your HR team a fair amount of time and energy.

Kenjo Interface

Kenjo Interface